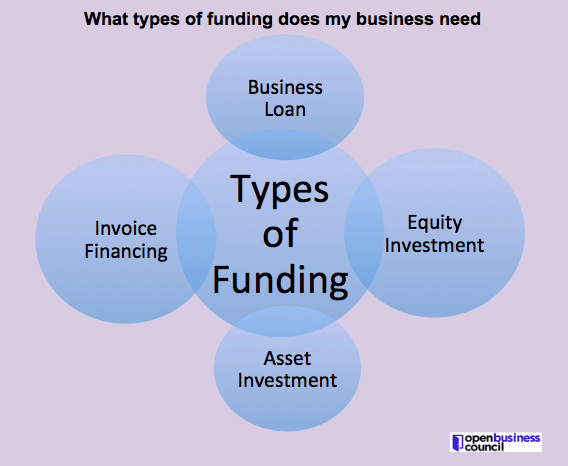

If you’re into start-ups and you’re unsure about the type of funding your business needs, this article will be of great help to you. Here, you will be acquainted with various funding systems that can help businesses thrive within a short period. It’s important to know that many people fail in their businesses due to lack of capital; sometimes, capital may not only be the only reason, but other factors and the uncertainties surrounding the business environmental may also play a role in hindering businesses to thrive. In this article, we’re going to look at some of the type of funding that a business might need.

1. Business Loan

Business loan is the most common type of funding for businesses. It is a loan specifically designed for business purposes to help those who want to take their businesses to another level. Business loan tends to assist small businesses and start-ups by provide capital and necessary funding needed for a business to stand. Many people have been utilizing business loans to boost their businesses and there have been lots of success stories from those who have benefited by this. It is unarguably one of the best ways to funds for your business. Moreover, business loans are facilitated by banks and other financial providers and funding are agreed based on terms and condition that give assurance of repayment by the business owner at a stated period of time. However, it’s important to know that a business loan is basically categorized into two – the secured and unsecured loans. The secured loan system is one that requires the applicant to make a list of collaterals in the process of application which will be forfeited in case he/she is unable to repay the loan after the repayment period has elapsed; while the unsecured loan system does not necessarily required collaterals to be listed during the application process.

2. Equity Investment

Experts see equity investment as one of the difficult and complicated type of business funding to obtain in the world. It works when investors put cash into business with the hope of becoming part of the stakeholders of the said business. While this may seems to be a complicated type of funding (because owners will have to invest share in a particular business before getting a percentage of the profit after sometimes) it is also helpful because equity investors can always recoup their money anytime they sell their shares in the business or when the business is sold in future.

3. Asset Finance

The asset finance is another type of business funding that can yield positive results if it goes well. Asset finance is a type of loan where businesses need to purchase expenses assets e.g. cruise ships or other equipments which will be used to source funds for the business. This works when the funder buys the asset and loans it out to an establishment for an agreed period to allow the business to have full control of ownership of the asset, where repayment plan can be put in place at agreed length of time. If this works well, it is one of the best type of business funding starters can opt for.

4. Invoice Finance

Many businesses prefer to use the invoice finance to get funds for their businesses, because it is easy to get and it’s straightforward. Invoice finance is a type of funding where a financial intuition is involved to assist business owners who have pending payment from buyers by purchasing invoices and give them an initial payment of up to 85% of the amount payable. For example, if a seller is owed by a customer, the sum of $20,000 the financial institution can purchase the invoice from the seller and pays him/her up to 90% of $20,000. The company will then follow up the customer and collect the money in full before settling the seller the remaining balance, but with interest charges. This type of funding is suitable especially when the business owner is struggling to get his or her money back from customers. The financial institution involve in this transaction can be a bank or non-governmental organization. In conclusion, it is important to know that there are many ways to adopt to get funded for a business, but what you need to do is to evaluate these ways and go for the one that best matches your budget and requirements.