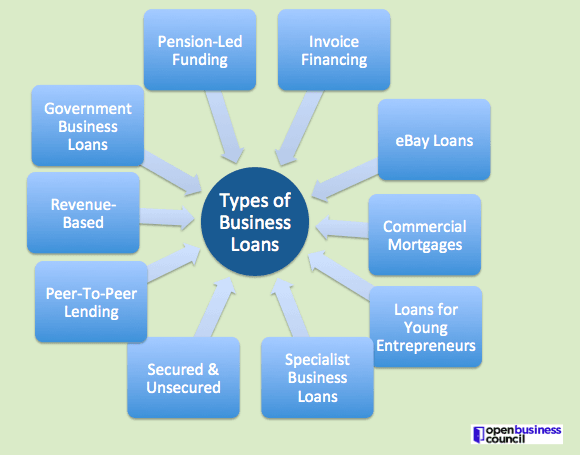

Business loans are those loans giving to individuals, groups, or organizations specifically for business purposes. Like any other form of loan system, the business loan also has its own types and we’re going to look at them one by one. Find out below, the 10 types of business loans you can find anywhere in the world.

10 Types Of Small Business Loans

1. Secured And Unsecured Business Loans

Normally, all form of business loans are traditionally split into two ways - the secured and unsecured business loans. The secured loans are those types of loans that require the borrower to submit collateral when applying for loan, as a security in case he/she has not been able to repay the amount after the repayment period elapse. The unsecured loan on the other hand, does not require collateral, but the lender can charge a higher interest in order to help adapt to any likely risk that may arise.

2. Peer-To-Peer Lending

Peer-to-peer lending, also known as p2p is another form of business loan that serves as an alternative way of financing for start-ups. In this aspect, business owners who are looking for non-traditional loans can utilize the peer2peer form of loans to enable help their businesses grow for the better. Funding can be sourced from multiple investors, crowdfunding sites, friends, families, etc. and it is regarded as one of the low-risks type of business loan system.

3. Revenue-Based Finance Loan System

The revenue-based financing is a different form, from the traditional type of business loans. It is regarding as one of the most convenient form of business loans starters should have, as it works only on the percentage of sales you make in a month. Meaning, the borrower will repay a certain percentage of sales every month until the loan is fully repaid or settled. Experts suggest that this type of business loan is more suitable for businesses that can be affected with seasonality, because they only pay what they can afford in a month.

4. Government Business Loans

The government business loan is a form of loan that is aiming at contributing to the economy. For example, the government of UK has deemed it fit to provide loans for the United Kingdom’s SMEs to help them grow in their businesses and also help improve the economic growth of the region. This is a good development because potential business owners can have the opportunities to pursue their dreams through the government business loans without any hassle.

5. Pension-Led Funding

This type of business loan is one that sees funds and capital released from business owner’s pension plans. It signifies that businesses can have the opportunities to leverage the value of their assets, which can be purchased or leased by the pension fund.

6. Invoice Financing

This type of lending involves the use of third party in the deal to enable business owners get money based on outstanding invoices before they’re been paid by their customers. The third party normally gives the business owner from 80% and above, of the expected income to use for their pressing needs before they later repay it.

7. eBay Loans

Small retailers who are generally comfortable with income via the internet can utilize this kind of loan system to boost their businesses for good. The eBay loans, also called “e-commerce loans” works by making application from your finance provider online (e.g. PayPal) where it will be processed and money will be released to you to help boost your business.

8. Commercial Mortgages

This type of business loan is designed to help those who want to purchase commercial properties for their businesses rather than renting them. In this aspect, commercial mortgage can be approved by up to 85% of the property’s value and can take a loan repayment period of more than 20 years with an option to pay an interest. There is another, faster way of purchasing commercial properties and that's by taking a private money loan from a trusted private money lender. These types of loans are easier to get but most lenders provide repayment terms from six months to seven years with usually a bit higher interest rates.

9. Loans For Young Entrepreneurs

Due to the records that the rate at which the number of young entrepreneurs keeps increasing day-by-day have given rise to formation of the loans for young entrepreneurs. This type of business loan involves the government and charity organizations to help young entrepreneurs (from 18 to 30 years old) with funds to boost their start-ups.

10. Specialist business loans

A specialist business loan is one that is given to businesses that have specific needs that they require the funds for. For example, if you want to buy a car, you can apply for a specialist business loan to your lenders and clearly specifying your needs. Or if you plan on growing your own crops, you can choose between various cbd business loans to help you get started. Many people and business owners have been benefiting from this type of loan, because it only deals with a specific need and the amount required for the loan.

Relevant Posts: What is a Business Loan?