The History of Invoice Financing.

The history of business Finance is mixed somehow with the history of finance. In order to run a business you need finance. Business finance has been evolving until modern times when alternative finance, trade finance and special the advent of fintech brought new opportunities for SMEs to advance and develop their businesses. Business Finance includes among other areas Invoice Financing and factoring. The history of Invoice Finance is critical for businesses and can be divided into two major branches: factoring and invoice discounting. And its relevant history is also divided into two parts. In these series of articles we will elaborate about the history of Invoice financing and its related products.

This first one we will elaborate on the History of factoring and History of invoice discounting. Invoice financing is a powerful part of the history of business finance and historically is a powerful relative secure way of borrowing for a business and fills in the time delays in theworking capital needs that a business faces for its growth and daily operations. It provides the much needed cashflow where longer payment days are agreed to with an end debtor. In short, a business raises money, finance against an invoice sent to a client, before the client has actually paid. In order for invoice discounting to work, a given financial organisation, alternative finance or bank will fund a percentage of the value of those invoices and usually take an assignment over the receivable and thus the money that will come in, in the future. It is rare that the full amount of the invoice will be advanced, and it is typically between 65%-90%. Once a facility is set up the amounts will change depending on amount and of course the frequency of invoices paid by clients, the respective credit risk on end debtors and how many invoices are generated during the process.

History of factoring.

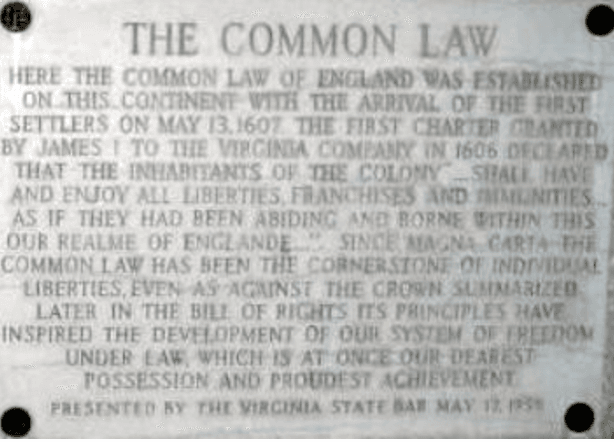

Factoring began in England before the 1400s and it was introduced into America by travelling pilgrims around the year 1620. These financing techniques are usually associated with merchant banking activities of the times, which evolved with non-trade related financing that crept into the market. Factoring has greatly changed like all other financial instruments. The main organizations changed, with the main reason being due to technology and air travel. There were further changes due to technological advances which supported non-face to face communications starting with telegraph capabilities, moving to the telephone and finally to computers. The common law framework in the United States and England are being modified which also drove some of these changes. The English common law stated that without the debtor being notified, a factoring facility between sellers of invoices and lenders are not possible. The legislation for the Canadian Federal Government still reflects this stance and so does the provincial government legislation that is modelled after it. By 1949 most of the state governments had adopted rules in the United States, stating that the debtors need not be verified which made the non-notifying factoring arrangements possible.

English Common Law

History of invoice discounting

This method of financing was introduced in the industry approximately 4000 years ago, when King Hammurabi ruled over Mesopotamia. This is the period in which the Babylonian and Sumer empires existed, which was eventually followed by Romans selling promissory notes to obtain discounts. Modern day financing can be traced back to the 1300s when money in Italy was offered against payment and delivery of grain. Following this, merchant banking was introduced when funds were exchanged for goods before they were shipped to other countries. Before the American Civil War, commodities and furs were transported to Europe through the colonies using intermediaries. Most of the finance flows were observed in the textile and garment industries as raw materials were being purchased and textiles being manufactured. These financiers offered funds to more foreign traders and dealers had to be appointed to handle customers who are overseas. The dealers were also responsible for selling, delivering goods and also holding all goods on consignment. The increase in invoice financing continued into the transportation and textile boom of 1940s. Banking regulations and rising interest rates discouraged most individuals from using traditional methods of financing. This article will continue with other parts.

This is an article brought to you by tradefinanceglobal.com. This is the first from a series of insights and general resources for SMEs and SMEs Trade Finance. Find out more about trade finance and invoice financing on: