- With the furlough scheme drawing to a close in October, a surge in unemployment is on the cards. Only a third of businesses said that they would definitely retain all of their furloughed staff, while nearly one in five (18%) indicated that they would not be doing so.

- Business conditions continued to improve in July, but only at a modest pace. Businesses’ profits are 26% lower than would have been expected were it not for the coronavirus crisis. This is only a slight improvement on the 29% figure recorded at the height of lockdown in mid-April.

- The continued easing of lockdown restrictions contributed to an uptick in business sentiment. The share of businesses with a positive assessment of current trading conditions (34%) is now similar to the share with a negative assessment (35%).

- Despite the reopening of the hospitality sector on July 4th, 80% of businesses in this sector had a negative assessment of current trading conditions in the latest survey (carried out between 9th July and 15th July). This suggests that for most pubs, restaurants and hotels, social distancing requirements, low numbers of tourists and many people’s reluctance to venture out mean that the business remains tough.

James Endersby, CEO at Opinium said “Britain’s businesses are clearly eager to get back to normal trading as soon as possible and most of the business community have responded positively to the government’s initial measures to get the economy moving again. Nevertheless, profits are still stubbornly down, and a sizable minority are still facing a serious threat of insolvency. This has left most business leaders still very much holding their breath, waiting to see if reality meets the hopes that consumers will return to spending in large numbers next month.”

Pablo Shah, Senior Economist at Cebr said “Economic conditions continued to improve in July, as further lifting of lockdown restrictions were met by a brightening of sentiment and reduction in insolvency risks. However, a concerning finding is that profits remained 26% down due to the coronavirus pandemic in early July, which is only a marginal improvement compared to the height of lockdown".

“Since March, many businesses have engaged in the fight of their lives to survive the unprecedent deterioration of trading conditions brought about by the coronavirus crisis. For many households however, the true test will come towards the end of the year as government support – most importantly the furlough scheme – is gradually withdrawn. While businesses remain broadly supportive of the government’s economic response, only a minority feel the £1,000 job retention bonus is the right path forward.”

Business Distress Tracker – full findings

Business insolvency risks

The gradual re-opening of the economy continued in July, most significantly with the re-opening of the hospitality sector on July 4th. However, the road ahead is littered with obstacles, and more than a third (36%, or 1.9 million) of businesses still feel there is a risk they will enter insolvency as a result of coronavirus-related disruption.[1] This includes more than one in twenty (6%) of firms that say there is a high risk of being forced to close permanently as a result of the coronavirus crisis.

Employment impacts

The latest instalment of the Opinium-Cebr Business Distress Tracker has uncovered a positive shift in the ways in which businesses are dealing with the global pandemic. Here, the proportion of workers facing furlough has dropped considerably from 30% two weeks ago to 23%. This change is further boosted by the fact that businesses do not appear to be offsetting this return to work with cuts elsewhere - there has only been a very slight increase in the percentage of workers who have had their hours reduced (27% increasing to 28%) and no change in the amount facing salary/wage cuts (remaining at 29%).

Business activity rates

The measure of economic activity provided by the Opinium-Cebr Business Distress Tracker has so far proved itself to be among the most accurate real-time measures of output, available several weeks before official data releases. It is therefore a significant cause for concern that despite the re-opening of key sectors such as retail and hospitality, businesses’ profits remain on average 26% below where they would have been were it not for the coronavirus crisis. This is only slightly better than the 29% slump in profits during the height of lockdown.

Economic recovery

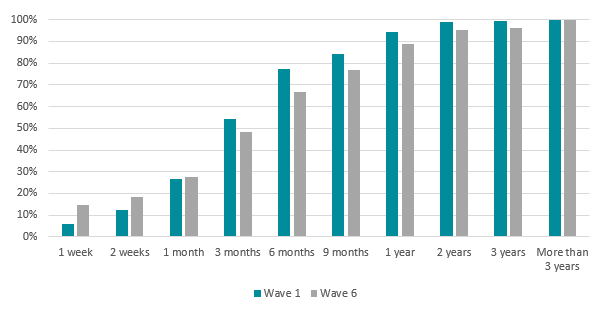

Businesses’ expected recovery times appear to have plateaued in recent weeks. In the latest wave of the tracker, businesses said on average that they would need 34 weeks after the lifting of restrictions to return to their pre-crisis levels of production. This is unchanged from the previous two waves of the Business Distress Tracker.

Figure 2 Cumulative share of businesses that have returned to pre-crisis production.

Figure 2 Cumulative share of businesses that have returned to pre-crisis production.