“The UK is excellent at creating and developing tech start-ups but there is a feeling in the market now that we need to concentrate more on scaling up businesses,” said Nick Travis, a partner in investment management at Smith & Williamson, the investment management, accountancy and tax group. “There is a big difference between the UK and US in the funding of new ventures, particularly amongst high growth areas such as Virtual Reality, Augmented Reality, internet of things, education technology and tech to assist the elderly. Venture Capitals in the US generally seem to think a lot bigger and invest a lot more money. Start-ups, particularly tech ventures, are far more able to scale in the US than the UK.” In the UK, only 50 per cent of respondents to the quarterly Smith & Williamson Enterprise Index*, a survey of business leaders, felt that there was access to appropriate funding and only one third had any appetite for borrowing when compared to three months ago, , highlighting how desire and ability to scale up a business is dampened within the UK. Tech is, by its very nature, a fast developing area. There are many popular “software as a service” companies which can help businesses save money, time and human resources. Additionally, companies such as Crowdcube and Funding Circle are fundamentally changing finance by challenging and disintermediating financial institutions. “It is vital that a business has an idea but they must also have the desire and ability to grow. One example of this was the funding of an internet of things care tech platform called Alcove. Alcove allows older people to assist the elderly in staying in their home for longer utilising the internet of things approach and a centralised tech platform – it aims to replace the red pull cord.”

“When we met them they were still developing the concept and we were happy to connect them with potential investors. They are now fully functioning in several Housing Associations and have saved lives! This could only be achieved through the hard work of those involved coupled with the appropriate people to invest.”

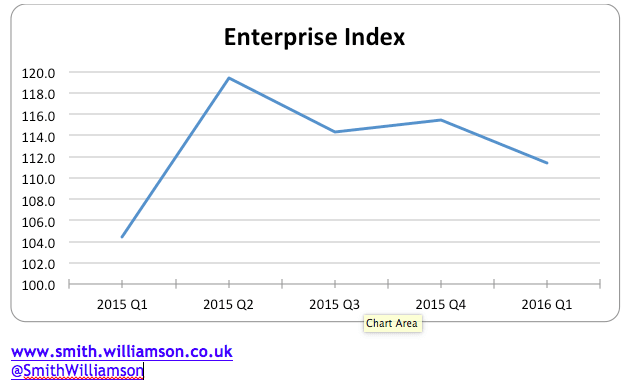

The Smith & Williamson Enterprise Index decreased four points to 111.4, its lowest point for 12 months. Brexit worries and concerns over the state of the UK and global economy appear to be the primary cause, as expectations for growth fell by 9%.

Talent problems affecting business

Business owners are becoming increasingly worried in the lack of skills available according to the Smith & Williamson Enterprise Index. Over 66% of respondents believed the lack of STEM (Science, Technology, Engineering and Maths) skills among students was hindering the scaling-up of British businesses.

“The stress on the available talent pool can’t be ignored; businesses must train more people and upskill their existing workforce as capacity remains tight but, equally, employees must come with the basic ingredients. This starts with education and encouraging students to acquire skills, an area where government policy changes and educationalists can have a big impact,” said Fergus Caheny, a partner in investment management at Smith & Williamson.

“We are increasingly hearing of talent moving to countries such as the US where the marketplace is perceived to be more attractive. It would be highly beneficial if action was taken to retain and encourage highly-skilled individuals to remain in the UK,” said Fergus.

Bitcoin continues to struggle

“Once heralded as the currency of the future, Bitcoin has taken severe hits to its reputation and popularity over recent years.

Whilst still having its place, as an international currency and within certain sectors, our respondents thought it would fail to become a widely accepted method of payment. 61% of respondents didn’t see it having a big impact on the major currencies and models of payment over the past five years,” said Fergus.

Risk warning

Investment does involve risk. The value of investments and the income from them can go down as well as up. The investor may not receive back, in total, the original amount invested. Past performance is not a guide to future performance. Rates of tax are those prevailing at the time and are subject to change without notice. Clients should always seek appropriate advice from their financial adviser before committing funds for investment. When investments are made in overseas securities, movements in exchange rates may have an effect on the value of that investment. The effect may be favourable or unfavourable.

About

Smith & Williamson is an independently owned professional and financial services group with over 1,500 people. The group is a leading provider of investment management, financial advisory and accountancy services to private clients, professional practices and mid-to-large corporates. The group has thirteen offices; these are in London, Belfast, Birmingham, Bristol, Cheltenham, Dublin (City and Sandyford), Glasgow, Guildford, Jersey, Manchester, Salisbury and Southampton. Smith & Williamson Investment Management LLP is part of the Smith & Williamson group. Smith & Williamson is the official sponsor for the National Business Awards’ search for the 2016 Scale-Up Business of the Year Award.