Property price increases are leading many middle-class families into the tax bracket. In order to avoid paying unnecessary tax, it is important to learn about inheritance tax (IHT). Inheritance tax changed in the 2015 budget, to allow people to pass on more to children or grandchildren without being taxed. According to The Office for Budget Responsibility (OBR) 4.8% of the population currently pays IHT. Due to property price, it is estimated though that by 2018-19 that figure will have more than doubled, to 10%. What can be done to avoid paying unnecessary tax? There are various reliefs and exemptions available that can help you reducing your IHT liability. This little guide introduces the reader to some concepts and offers some tips for reducing your estate’s exposure to IHT. You should talk to your financial adviser or if you don't have one, you should find some help.

Alexander, an accountancy and consulting firm, can help you with your plans for your estate and see if IHT planning can help your beneficiaries when the time comes.

What is IHT?

Inheritance Tax is a tax on the estate (the property, money and possessions) of someone who’s died. IHT is charged on your estate at 40%.

What is “nil rate band”

Nil rate band (NRB) is the amount which a person can leave on death with IHT being charged at zero (i.e. no tax is payable on it at all). Everyone who his a resident in the UK has a ‘nil rate band’. The current NRB was changed. The current threshold is £325,000, but from April 2017 a new, higher threshold including a “family home allowance”, will begin to be phased in.

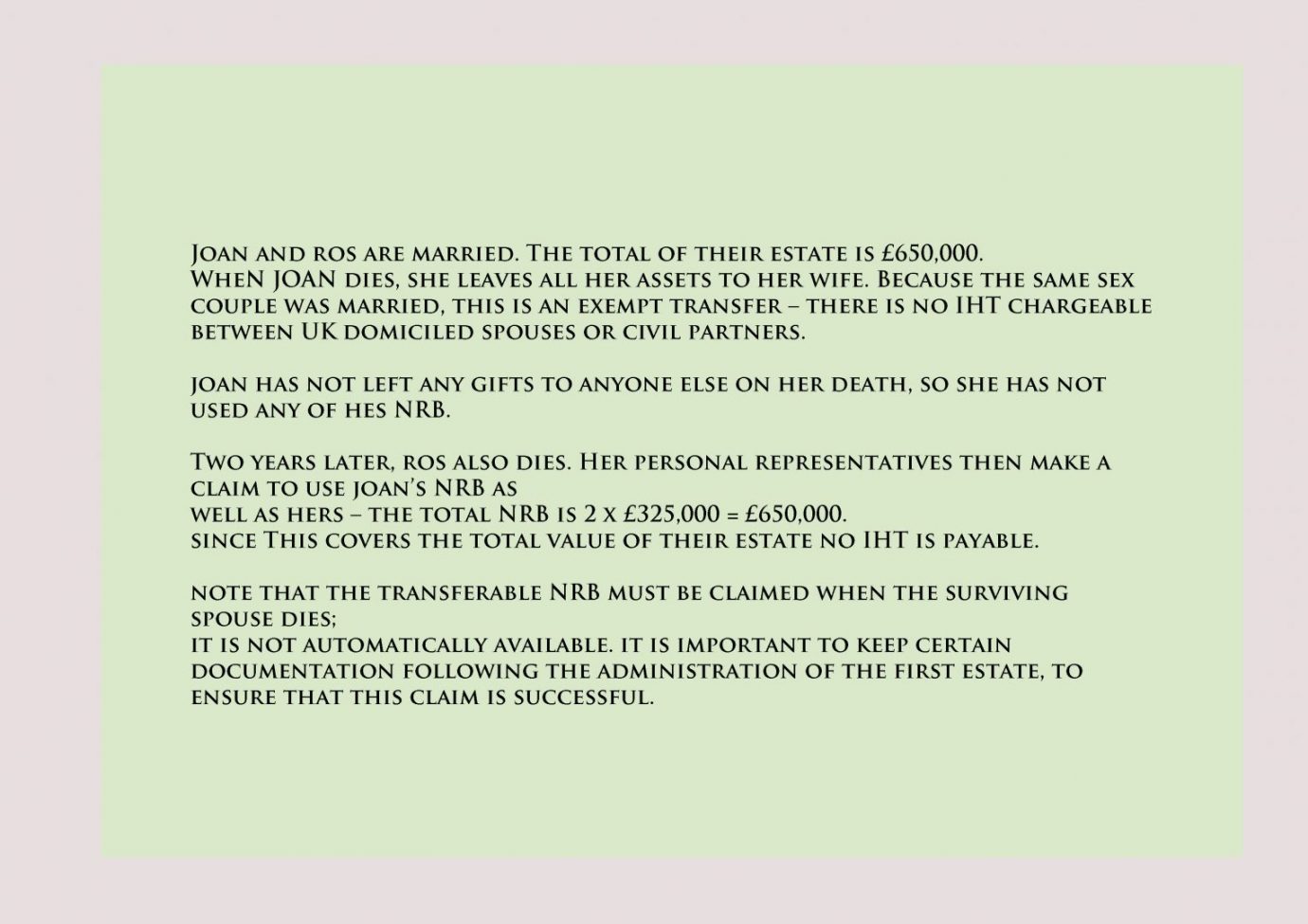

The Transferable Nil Rate Band

In previous years, unless an individual used their NRB upon death, it was lost. This often used to be the case where, for example, a husband died and left all his assets to his widow. When transferring his assets to the widow, even though this would be exempt from IHT, the husband would be wasting the NRB. Since 2015 it is possible to transfer NRB. ‘Transferable NRBs’ must be claimed though when the surviving spouse dies as it is not automatically available. In the example above, due to the transferable NRB, if claimed, the widow will also inherit any unused portion of her husband’s NRB. This will then allow her to leave more to her children without them having to pay IHT.

Example of IHT

Exemptions

Some exemptions to IHT are gifts made during someone’s lifetime. These include interspousal gifts, small gifts, annual exemption, wedding gifts, payments or gifts from normal expenditure, charitable gifts. Be careful to understand what it is meant by gift. According to the HMRC, a gift can be:

- anything that has a value, eg money, property, possessions

- a loss in value when something’s transferred, eg if you sell your house to your child for less than it’s worth, the difference in value counts as a gift

On small gifts you make out of your normal income, for example Christmas or birthday presents, there is none IHT to be paid. These are known as ‘exempted gifts’.There’s also no Inheritance Tax to pay on gifts between spouses or civil partners. You can give them as much as you like during your lifetime - as long as they live in the UK permanently. Other gifts count towards the value of your estate. There may be Inheritance Tax to pay if you’ve given away more than £325,000, but only if you die within 7 years.

Charitable gifts

You can make gifts to certain organisations free from IHT implications. Examples of charitable organizations are qualifying charities established in the EU or another permitted country, some institutions, for example, the National Trust and certain political parties. If you make a charitable gift through your will you will be able to reduce the rate of tax that applies to your taxable estate to 36%, provided that you meet certain qualifying criteria.

Conclusion

With property prices skyrocketing, it is important to know about IHT since more and more people might be liable to pay it. This small guide about IHT covered some essentials concepts and rules about inheritance tax. For the more complex areas of IHT planning, it is important to seek professional advice before taking action.