Stock finance, or inventory finance, is a way of raising additional finance against the stock owned by your business. The type of stock is an important aspect as the exact mix and amount of stock finance available will depend on the type of stock you have and the amount of finance you require. It allows you to raise additional working capital as a stand alone facility or as part of an invoice finance facility. Stock finance is a technique that saw working capital being released from stocks in form of raw materials or finish goods. Stock finance works when lenders purchase stock from sellers on behalf of the buyers. Simply to say, if a buyer does not have money to buy stocks, lenders can facilitate the deal to go through and buy from the seller before the buyer can have access to the stock. However, many people tend to see stock finance as a direct form of straight funding, but in the real sense they are two different formats of funding. Stock financing deals with the purchase, movement, goods, services, and every other thing that has to do with domestic and international transaction. Moreover, it’s important to know that stock finance may not always go smoothly in the case of international transaction, because there may be challenges and risk in the exchange of foreign currency. However, lenders used to adopt some strategies such as letter of credits or a bill of exchange to make every international transaction safe and easier. In this article, we’re going to look at some important things about stock financing.

What Services Stock Finance Can Cover?

Stock finance does not only involve buying of stocks from a seller on behalf of a buyer, has a lot of services which can be facilitated through stock finance. These are:

- Insurance cover

- Lending services

- Factoring services

- Taking care of anything that has to do with export credit

- Issuing of Letter of Credits

- And more.

What Are The Various Types Of Stock Finance?

Stock finance has several forms of which they can be useful in both domestic and international transactions. Below are some of them.

- Guarantees stock finance

- Discounting finance

- Import and export finance

- LCs finance

- Tailored solutions finance

- Forfeiting of bill of exchange finance

- Trade credit financing

- Factoring financing

- Credit insurance financing

How Does Stock Finance Works?

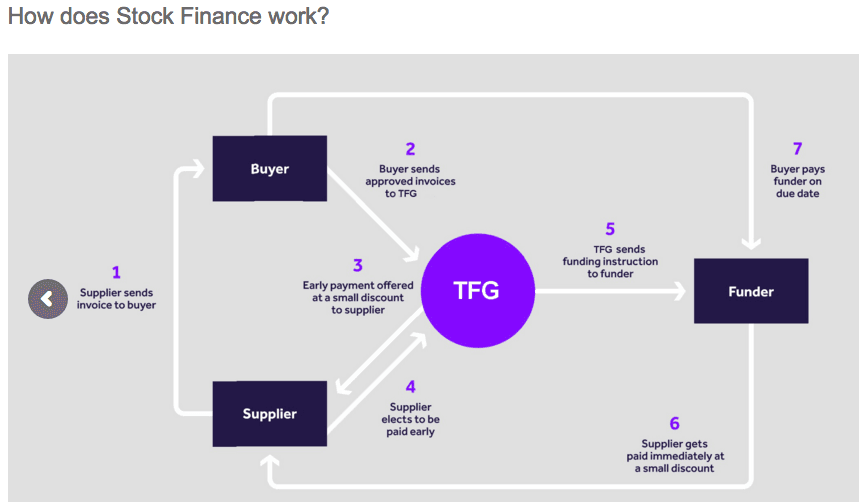

Stock financing works by involving up to 4 different stakeholders - The supplier, buyer, TFG, as well as the funder. Here is how it goes.

- The supplier will send invoice for the supplies of goods and services to the buyer.

- The buyer will then send approved invoices to the TFG.

- At this stage, early payment at a discount rate will be made to the seller or supplier.

- The supplier may wish to request for payment and the TFG will forward the request to the funder or financier of the transaction.

source: Stock Finance, The 2016 Guide for Importers and Exporters

Positive Reasons Why Stock Financing Is Needed?

It’s important to know that there are many reasons why stock finance should be adopted by many businesses. Here are a few.

- To cover risk

In any business (especially international business) there are associated risks when money is involved. Stock finance tends to cover those risks associated with international business and cash flow. For example, in international trade, there is always a risk delivering goods and services before payment is made. The supplier will be taking the risk of supplying goods and service before payment is done. The buyer, on the hand, may also be taking some risks to make payment for goods or services before they arrived. So, in order to mitigate this risk, stock financing has to come in to stand as an intermediary in any of the international trade between buyer and supplier. In this case, a letter of credits is used to ensure guarantee of payment by a bank to the exporter on the basis of export contract.

- Hassles-free transaction

Import and export of goods and services through stock finance can present a number of benefits. One of these benefits is a smooth running of transaction between supplier and the buyer. It facilitates and makes everything easier for the parties involve.

- It provides security in any transaction

Stock finance is transparent and provides security by tracking all of the activities involving transactions to both domestic and international level. It works with various mitigation techniques and also offers technological advances to ensure that all risks are mitigated when it comes to payment and delivering of goods and services. Hope you find this article helpful and will make best use of it.