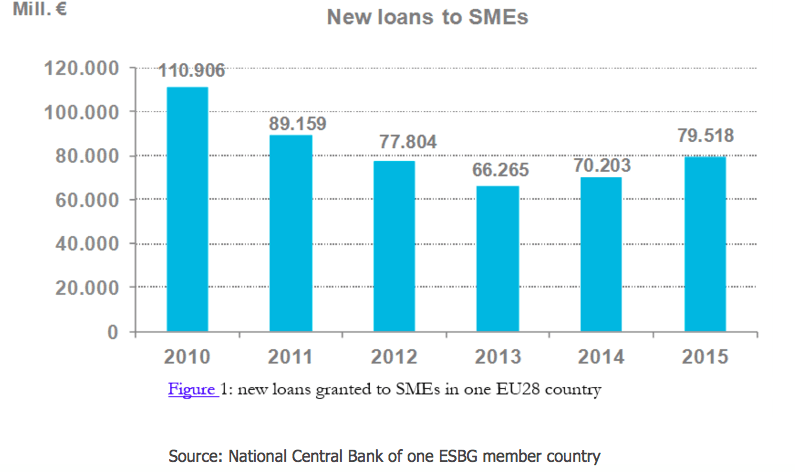

According to ESBG, the European Savings and Retail Banking Group, that brings together saving and retail banks of the EU and EEA, in the first half of 2015 new loans to SMEs rose by 13% compared with the same period of 2014. Table below shows the growth of SMEs loan in EU country in EUR.

In the UK in 2015 net lending to SMEs was £2.1bn. As suggested by BBA, the leading trade association for the UK banking sector with 200 member banks, it was the first annual rise since 2011.

Cash holdings also rose by 7% such that deposits exceed borrowing by more than £60 billion and finance applications were approved for 8 in 10 smaller businesses and 9 in 10 medium businesses.

Although compared to 2014, the number of applications form SMEs slowed in 2015, by 13% for loans, it is important to consider bank loan as an option for business growth and how to do it is a vital strategy. Small business loan is a type of loan specifically designed for start-ups or those who have small-scale businesses, with the aim of helping them to boost their productivity and yield more profits. However, it’s important to know that many business owners want to get small business loans, but do not know how to go about it and they will end it all by giving up, which in turn will make their businesses continue to struggle till a miracle comes from somewhere. It’s important to note, some business owners may not find it easy getting loans from the bank due to some reasons beyond their control. However, when you know what you want and the process involve in acquiring a small business loan, chances are everything will be done without any hassle. In this article, we’re going to look some tips that can help you apply for a small business loan and get it without hassles.

- Define Your Needs

You need to define your needs and know exactly what you want. This will give you an insight and courage to go for business loans. It’s important to know that when you aren’t clear and have double minds regarding your business, chances are all your efforts will end up like chasing the wind. It’s important to consider how much you need, the type of loan you want, and then think about the terms and conditions involved before opting for one. This will give you direction, as you start sourcing funds that can help boost your business.

- Evaluate Your Options On Different Lenders To Make The Right Choice

You may have been patronizing a particular bank or you may have registered with an institution that also offers loans for individuals; that doesn’t mean you must apply for business loans through them. You are expected to evaluate different options that are available and then make sure you choose the one that has the most favourable terms that matches your requirements. Do not let anyone influence your decision, it is your business and only you know what you want and what you’re going to expect, therefore it will be good if you can evaluate your options and choose the right lender.

- Conduct A Credit Check

Although new businesses may find it difficult to gain credits ratings, but if you can run a credit check before meeting with your potential lender, will play a big role and will make them process the loan very quickly without any hassle. For example, if the Bank you want to obtain a loan with sees that you have a very good credit score, chances are they will enlist you as one of their favourites and will process your loan without delay. Small and new business owners who may have difficulties in getting a credit rating can get a personal rating to show that they are well-qualified to be given the loan.

- Find Out More About Your Business Growth Opportunities

Some Banks may wish to know how successful your business can become in the near future; therefore, you should be able to convince them that there are so many money-making potentials associated with the business. However, to do this, you will need to conduct a market research and find about your business growth potentials and also some information about your competitors. This will give you an insight to understand more about the business and can as well impressed your lender.

- Create A Good Business Plan

Some lenders will like you to show them your business plan when applying for a business loan, this is important because they will be able to get convinced quickly and can make them approve your loan request in time. So, it is important to have a comprehensive business plan handy whenever you’re preparing to seek for a business loan.

- Ask The Bank Questions Before Giving You The Loan

This is one of the most important thing business owners tend to overlooked when looking for business loans. As a business owner, you need to ask your lender questions about their terms and conditions even if it is clearly written in the loan agreement document. This will provide an interactive section between you and them, and it will help you to understand more on what to expect. In conclusion, it’s important to know that if you’re able to apply these tips when looking for a business loan, then you are good to go There are other ways to received loan to grow your business, such as grants or individual investors programs like the one offered by fundingcircle. Also But we'll discuss them in our next post. Just keep watching our publications!