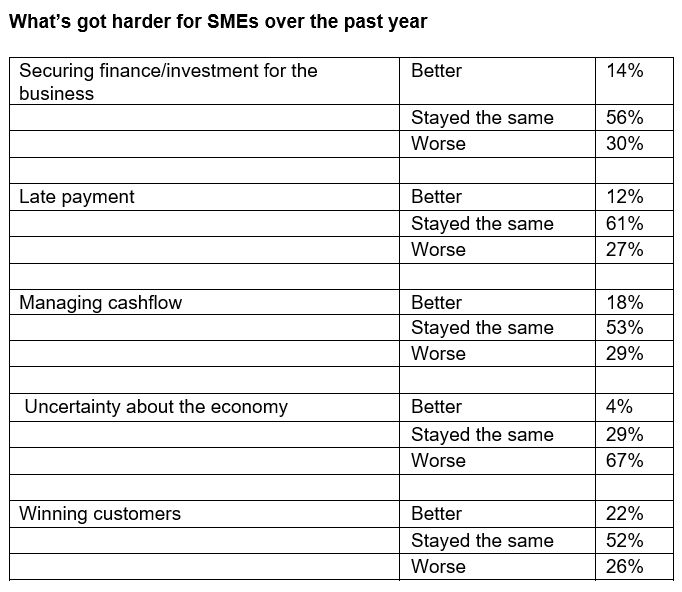

Late payment problems have worsened for 27% of UK SMEs according to research conducted by Purbeck Insurance Services, an insurance provider. Likewise, the report found that 29% are experiencing worsening cashflow problems and 30% of UK SMEs are finding access to finance has become harder in the past twelve months. The findings have been revealed as the UK Government confirms it is proposing new measures to stamp down on late payments to small business. While concerns over the economic uncertainty have deteriorated over the past year for 67% of the small business owners surveyed, for 60%, exchange volatility has made their business harder. Todd Davison, Director of Purbeck Insurance Services said:

“We welcome the Government’s new proposals which include fines for larger businesses who pay their small business suppliers late and reforms to the Prompt Payment Code. Late payment has a huge impact on cashflow – and poor cashflow kills businesses. Small businesses have simply lacked the muscle to make their larger customers pay on time and big businesses have used this to their advantage – we hope these measures will shift the balance of power."

What's got harer for SMEs over the past year. Source: Purbeck Insurance Services

Access to funding is also major challenge for smaller businesses deemed to be a bigger risk to traditional lenders – this is despite a Government initiative to ease the issue through the Bank Referral Scheme. Mr Davison pointed out also that when funding becomes a problem, cashflow dries up and late payment increases, creating a vicious circle where SMEs aren’t paid so stall payments themselves. However there are an increasing number of options available outside of traditional lenders so it’s vital they access expert advice to work out which finance solution is right for their business. In some cases business directors may face the uncomfortable prospect of taking a Personal Guarantee to secure a loan. However the risk to their personal assets can be mitigated through Personal Guarantee insurance. It is also possible to negotiate the terms of the Personal Guarantee so that the risk can be shared with other company directors and the amount of the Personal Guarantee can be reduced.

“Seeking professional support and allowing time to shop for the right finance deal is vital. Fundamentally business directors need to understand exactly what any new finance deal entails, the risks involved and how those risks can be mitigated,"he concluded.