As we enter a new decade, 58% of small businesses in the UK anticipate a plateau, or for their SMEs to struggle to stay in business. Only 1 in 4 predict to see growth. But not everything is bad news, here we also provide 5 tips that businesses can use to stay afloat in the digital era.

A new report, which surveyed 1,000 small business owners and sole traders across the country has been carried out by financial technology experts, Takepayments Limited, unveiling a snapshot of the small business landscape in the UK. It uncovers key challenges for small businesse and tips on how business owners can secure a more consistent cash flow. Below the report unveils the five biggest reasons why SMEs are struggling to stay afloat in a digital era.

Why SMEs are struggling to stay afloat in a digital era

Needing to chase late payments

Even if you are a business to consumer (B2C) company, the likelihood is you will still need to manage some partnerships and affiliations with suppliers etc. Perhaps you are providing a service or a product to another business and therefore, charging for the exchange. One worrying issue for small businesses that have to deal in a B2B scenario, is waiting for others to pay their invoices for the sale of your goods/service. Whilst wanting to maintain a positive working relationship between your business and theirs, when people do not pay their invoice on time, it leaves you short-handed for that months revenue and cash flow can become tight. 46% of small businesses have admitted to consistently needing to chase late payments with over half of them claiming that late payments have a worrying impact on cash flow.

The Uncertainty of Invoicing

As a small business, you do not have the luxury of sending all your money related tasks to the tax & finance department and will most likely have to do this yourself, unless you have someone externally handling all your businesses finance. For those running a small business, well over half (63%) claim that they are “self-taught” about tax and invoicing. All whilst, 39% say that they aren’t confident using online banking for work. Struggling to invoice effectively can result in a much slower process of receiving money, especially if the invoice needs to be amended and sent back to the supplier or there are important details missing. Therefore, it will come at no surprise that the better part of half (45%) of business owners say that finding funding to grow their business is holding it back.

Little to no tech support

Over half of SME's have claimed that they have little to no tech support, and are having to figure things out for themselves as they go along. Unlike a larger corporate who have entire teams to solve all types of IT or development issues, they must press on and do what they can with limited knowledge. With 47% having a lack in website creation and management skills, it is apparent that it is one of the key problems that is holding small business owners back in a digital era, where consumers expect to be able to find everything they need in the click of a finger. From issues with having poor WI-FI in their business location (39%) to struggling with online competition (45%), SME's are now expected to be tech guru's to stay in business.

The fear of a cashless society

Digital payment systems such as EPOS and pin machines are an expected method of payment to consumers now, with contactless limits getting higher and minimum spend becoming lower, there is a burden and expectation for small businesses to support the payment process of a becoming cashless society. Sandra Rowley, Head of Marketing at Takepayments Limited, commented about this that:

“Pricing structure and cash flow are both key to driving a business forward and yet for small businesses, many have had no or very little training. There are plenty of online courses available but, it’s not just training that can help.

Technology such as Electronic Point of Sale (EPOS) systems can be beneficial in giving key insights real-time to business performance, saving time on accounts and getting a true reflection of what products and services achieve the best margin.

Our study revealed that 49% of small businesses have seen a decrease in consumer spending and so implementing technology to improve your business could be a smart step to help overcome a variety of finance-related challenges.”

42% of SME's said that turning into a cashless society will negatively impact their business. This majority comes from the 40% that feel l overwhelmed by digital payment systems such as EPOS and chip and pin machines. If there is little advice, training and aftercare in the setup, it can be a daunting task tracking your income from EPOS machines, over counting cold hard cash.

A lack of social media marketing knowledge

The report revealed that Facebook was the most preferred social media network to market a business. The popularity of social media such as Instagram and more image/video-led content, like TikTok, are very high engagement sites but must be utilised properly from a business perspective. Nearly HALF (47%) of small business owners are struggling to do little if any social media marketing due to their lack of knowledge. Social media can be a cheap we to extend and gauge new audiences, however, with little knowledge small business owners are worried about keeping up on social media marketing and therefore, missing out on sales opportunities. From the results in the report, it will come at no surprise that the better part of half (45%) of business owners say that finding funding to grow their business is holding it back and they will struggle just to stay afloat.

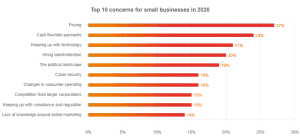

Top 10 concerns for small businesses

Top 10 concerns for small businesses

5 Tips For Small Businesses

Sandra Rowley, Head of Marketing at Takepayments Limited provides 5 tips for small businesses

1. Face technology head-on:

Technology can be daunting but, it brings with it so many advantages. Whether you look to implement new systems or improve old ones, businesses need to make sure they are adapting alongside the rest of society. You could be alienating some customers by not keeping up.

2. Review company sustainability and ethics:

51% of small businesses have noticed clients/customers are caring more about sustainability over the past year. This trend is set to grow further in 2020 and businesses need to make it a consideration in all areas, from supply chain to décor, employee wellbeing and product packaging.

3. Get online:

With the local high street struggling, businesses need to look to other platforms to grow such as online channels. 52% say social media has helped their business grow and gain new customers but a lack of knowledge in how to do this is holding people back.

4. Take care of your work-life balance:

Small business owners are known for being hard workers, 1 in 6 do not take 2 rest days (non-workdays) per week and only around half (57%) stick to a 48-hour working week or less. Make 2020 the year you implement a healthier work-life balance for yourself and your team. Though your working less, productivity levels are likely to improve.

5. Keep up to date on EU news and changes:

There will be plenty of change over the year following Britain’s exit from the EU, so make sure to stay up to date with news. Especially if your business is reliant on imports and exports. 42% are worried about potential changes to rules regarding this.